Brought to you by Mutual of Omaha Mortgage

Good News: Inflation Is Easing

The latest inflation report brought a welcome surprise—prices are finally cooling down. In March, overall inflation dropped to 2.4%, and “core” inflation (which excludes food and energy) fell below 3% for the first time since early 2021. That’s a strong sign that the economy is starting to stabilize.

But while the numbers are improving, the headlines are still making people nervous. Consumer surveys show that many Americans still expect inflation to rise, likely due to talk of new tariffs and global uncertainty. It’s a reminder that what we feel and what’s actually happening can sometimes be two different things.

Mortgage Rates: Still Bouncing Around, But Staying in Range

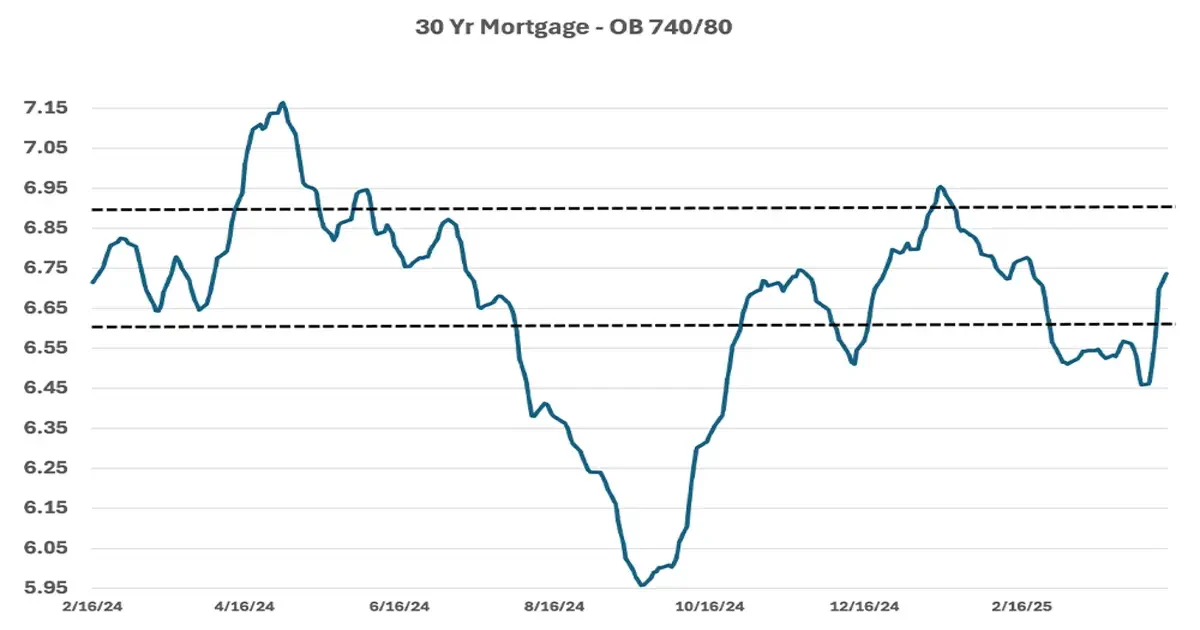

After a quiet stretch in March, mortgage rates spiked again in early April—reaching their highest point in two months. But zooming out, rates have actually stayed in a pretty consistent range (between 6.60% and 6.90%) for well over a year.

We know it can be stressful to see rates move day to day, but the bigger picture shows more stability than you might think.

Is a Rate Cut Coming?

The Federal Reserve is keeping a close eye on inflation and the overall economy. While there’s only a small chance they’ll cut rates in May, the odds go up significantly for June. If inflation continues to cool, we could see relief as we head into summer—just in time for peak home buying season.

What This Means for You

If you’re thinking about buying a home, here’s the bottom line:

- Rates may fluctuate in the short term, but we’re still in a historically healthy range.

- Inflation is improving, which gives us hope for rate relief later this year.

- We’re here to guide you, every step of the way—from pre-approval through closing.

At Mutual of Omaha Mortgage, we know that the decision to buy a home is about more than just numbers. It’s about timing, confidence, and finding a trusted partner to help you navigate the process.

Have questions about the market or what you can afford? Reach out anytime. We’re happy to talk through your options and help you make a confident move—whenever the time is right.